Modern Portfolio Theory (MPT) is a useful theory that shows how investors can construct a portfolio of assets that maximises expected returns for any given level of risk.

You’re probably familiar with the saying “don’t put all your eggs in one basket”, a short but effective analogy for explaining diversification. Spread the money in your portfolio across different investments, and it should reduce risk.

MPT is useful in that it provides a theory to determine which combination of investments (assets) you should spread your money across, in order to achieve the lowest possible risk for your desired level of expected returns.

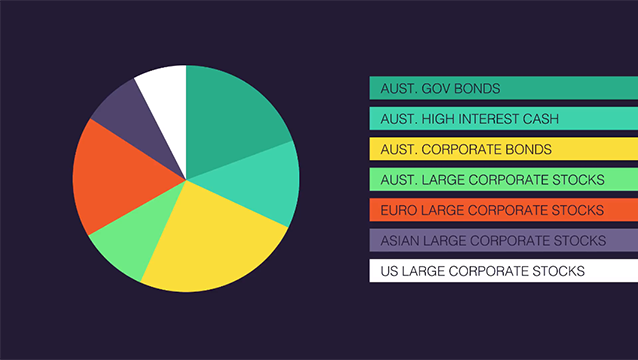

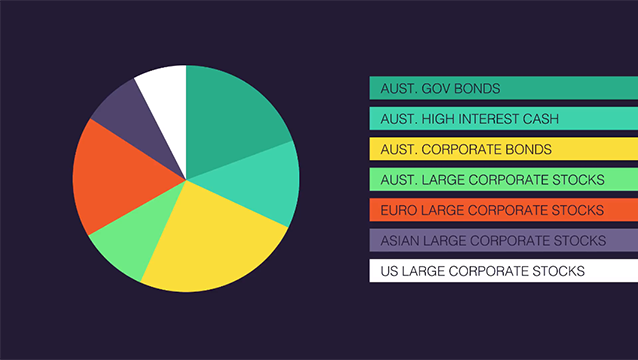

Assets are not limited to one class of investments, such as shares in Australian companies, but include a range of assets such as bonds (government and corporate), domestic shares (Australian) and international shares (US, Europe, Asia etc). This allows for a more robust diversified portfolio.

In its simplest form, MPT answers this question:

I’m willing to take on this level of risk, what assets should I include in my portfolio to maximise my expected returns?

How does Modern Portfolio Theory work?

The first step is to calculate the expected returns and risk (measured as the variance of returns) of a combination of assets. Risk is often a historic measure not a forecast. Expected return however is often a forecast, so if this estimate is incorrect then so is the portfolio construction.

When calculating variance, you also calculate the covariance (correlation) between assets. If two assets share a strong positive correlation, it means that both assets tend to move up or down in value at the same time. The implication of this being that investing in two positively correlated assets would be riskier than investing in two non-correlated assets.

Risk can be lowered in MPT portfolios by investing in non-correlated assets. This means assets that might be risky on their own, can actually lower the overall risk of the portfolio by introducing an investment that will rise when other investments fall.

However, correlations also tend to be historic measurements, not forecasts, and are thus subject to possible change as the past is not necessarily a good prediction of the future.

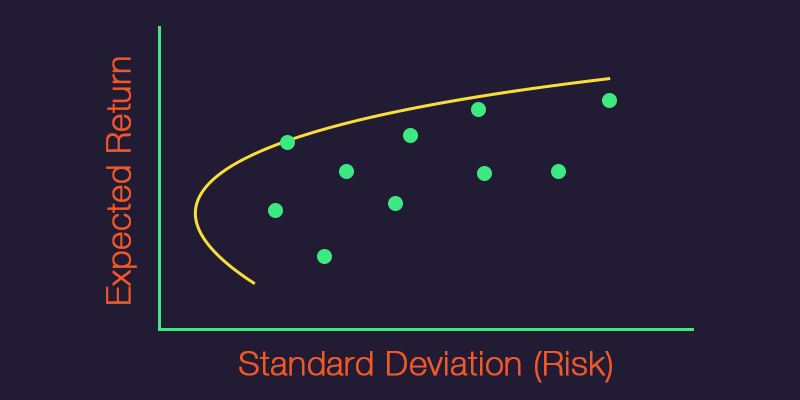

Being able to calculate a portfolios risk and expected return allows you to plot every possible combination of assets on a graph. The graph has portfolio risk on the X (horizontal) axis and expected return on the Y (vertical) axis. Using this plot, you can determine the most optimal portfolios for a given level of risk or expected return.

For example, assume we are looking to construct a portfolio with a standard deviation in risk of 7%. Using the graph, we could see that Portfolio A has an expected return of 8% and a standard deviation of 7%, whilst Portfolio B has an expected return of 6% and a standard deviation of 7%. Investors would consider Portfolio A to be more ‘efficient’ because it has the same risk but higher expected return.

Keep in mind that past performance is no indication of future performance, however it can be used to understand the best possible portfolio mix with the least amount of risk.

How Raiz uses Modern Portfolio Theory

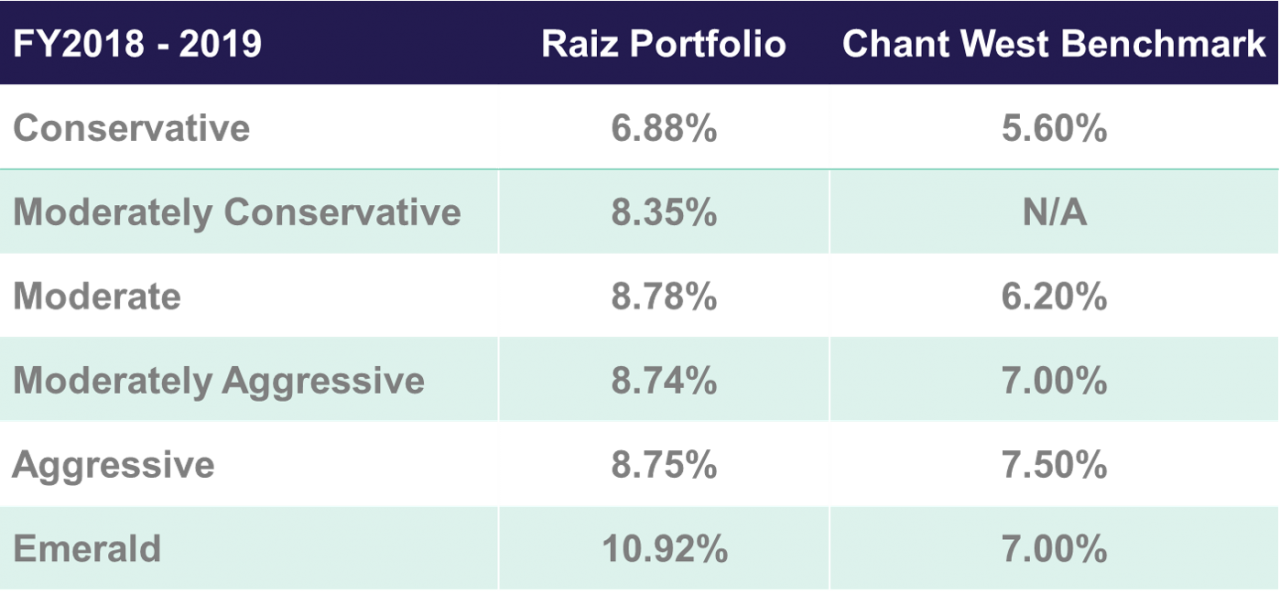

The Raiz Portfolios were put together with the help of the Nobel Prize winning economist and father of Modern Portfolio Theory, Dr. Harry Markowitz. Using MPT our portfolios are designed to give you the best possible returns for the least amount of risk.

The risk, correlations and expected returns are all based on historic performance.

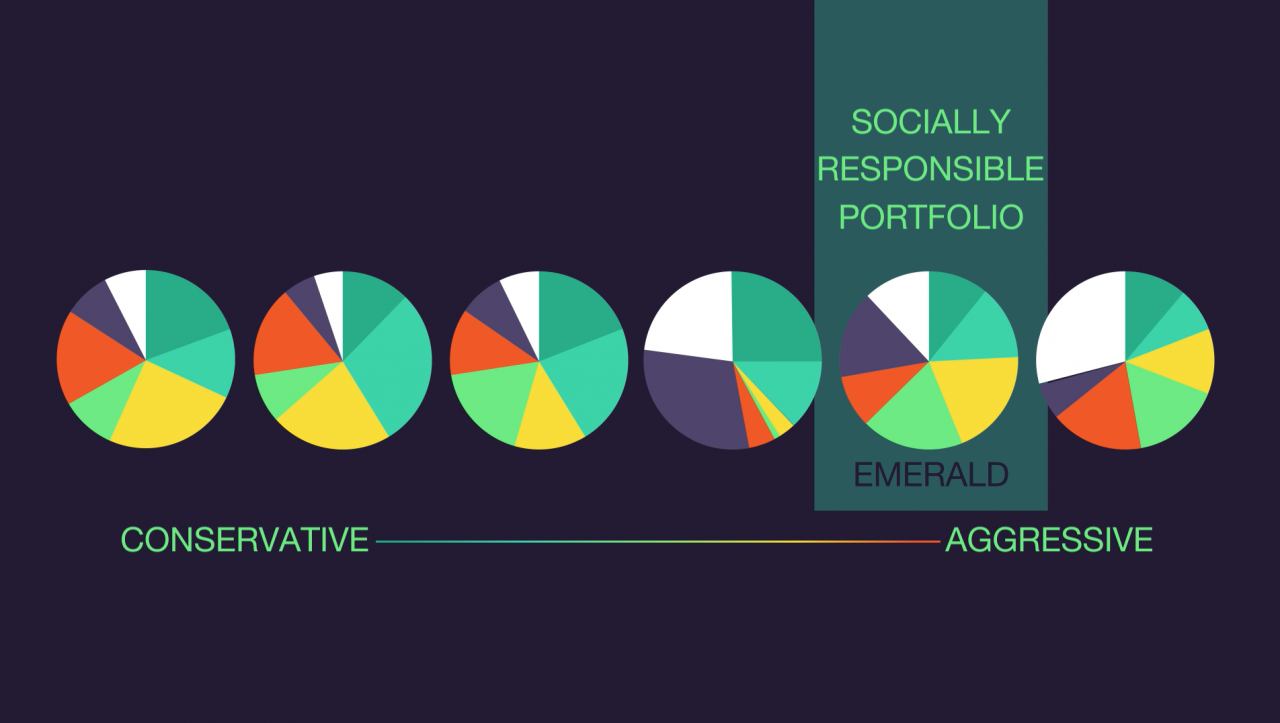

We use a total of 9 different ETFs to construct our portfolios. In each portfolio these ETFs are allocated a certain percentage depending on the desired level of risk for that portfolio. For example, the more conservative portfolios have a larger percentage allocated towards government bonds, which are generally less risky than equities.

The benefit of micro-investing with Raiz, which allows fractional holdings in the ETFs, is that with a minimum investment of $5, this amount is allocated across all ETFs within your portfolio (Bonds, Australian shares, US shares, Asia shares, Europe shares etc). For more information on Raiz fees, click here.

If you were to create one of our 7 ETF portfolios through a broker, you would be required to purchase all 7 ETFs separately, incurring possible trading/brokerage fee for each of these 7 trades.

You would also need much more money to invest in the portfolio as brokers don’t allow fractional holdings to get the correct weights in the portfolios (i.e. you can only buy whole units of an ETF). An ETF can trade for more than $300, and if, for example, it only made up 10% of a portfolio, you would need to invest $3,000 into that portfolio to get the correct weighting.

Automatic rebalancing is our method of maintaining your specific portfolio allocation. Market fluctuations may cause some of the securities in your portfolio to appreciate or depreciate in value. When this occurs, we use automatic rebalancing to bring your portfolio back to its specified allocation. This ensures that the securities in your investment account are proportioned correctly to match the allocations deemed most optimal according to MPT.

If we’re getting technical, it also allows us to pick up the concave risk associated with the rebalance while also benefiting from the convex risk associated with index funds. That’s a blog post for another day.

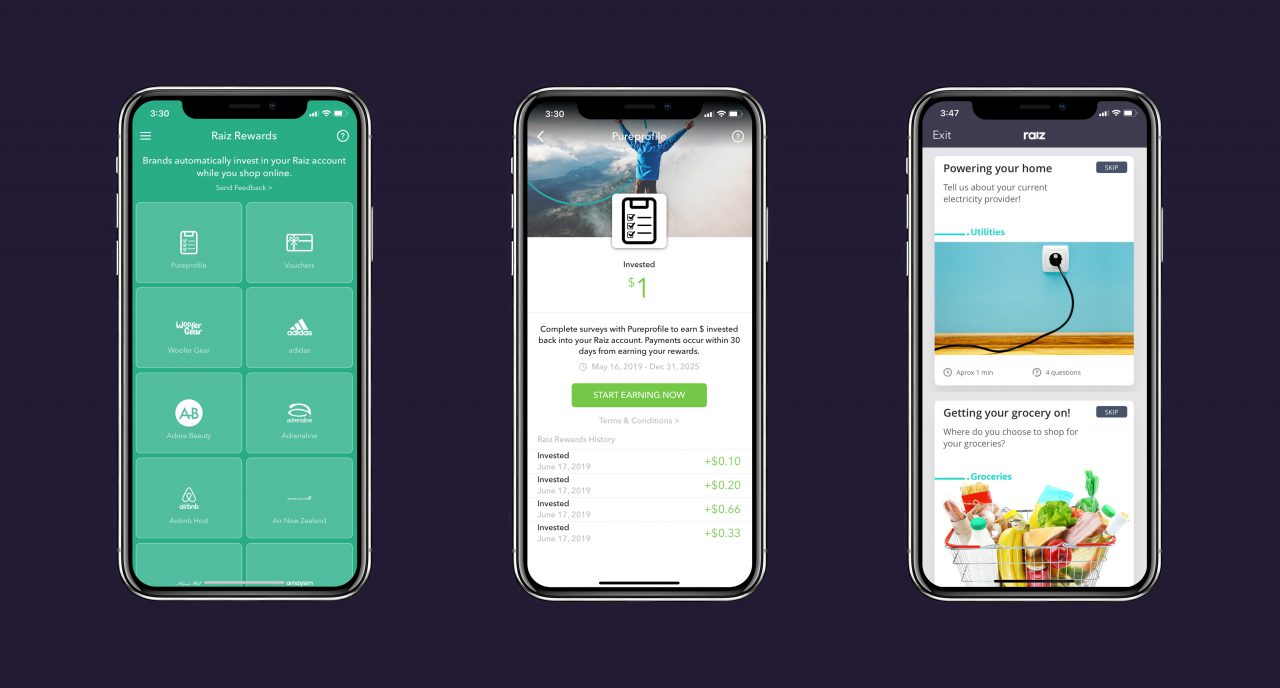

Don’t have the Raiz App?

Download it for free in the App store or the Webapp below:

Important Information

The information on this website is general advice only. This means it does not take into account any person’s particular investment objectives, financial situation or investment needs. If you are an investor, you should consult your licensed adviser before acting on any information contained in this article to fully understand the benefits and risk associated with the product.

A Product Disclosure Statement for Raiz Invest and/or Raiz Invest Super are available on the Raiz Invest website and App. A person must read and consider the Product Disclosure Statement in deciding whether, or not, to acquire and continue to hold interests in the product. The risks of investing in this product are fully set out in the Product Disclosure Statement and include the risks that would ordinarily apply to investing.

The information may be based on assumptions or market conditions which change without notice. This could impact the accuracy of the information.

Under no circumstances is the information to be used by, or presented to, a person for the purposes of deciding about investing in Raiz Invest or Raiz Invest Super.

Past return performance of the Raiz products should not be relied on for making a decision to invest in a Raiz product and is not a good predictor of future performance.